Three Types of Reindustrialization

And one phony type

By Patrick Hunt

There’s a lot of excitement these days about reindustrialization. As Austin Bishop relays in a recent Tool or Die episode, simple plans for a 50-person meetup last year turned into the incredible Reindustrialize conference with attendance in the hundreds. (Alex is seeing the same excitement for the afterparty he’s throwing at this year’s conference. Don’t miss out.)

But we don’t always mean the same thing when we talk about reindustrialization. I’m tracking three different types of Reindustrialization…and one red herring we should all avoid.

Type 1: Deep Tech Hardware

Deep Tech hardware will fundamentally reshape the American economy. Its impact will be seen in capex, employment, emissions, construction, and education. Automation and electrification are reshaping what we make and how we make it, like at Havoc AI and Fervo. Many of these changes will take place in the United States because we’re uniquely strong at building and financing new technology companies. Even industries without a historic American presence will find growth concentrating here because we’re so good at startups. A lot of the reindustrialization through Deep Tech hardware is actually “new-industrialization.”

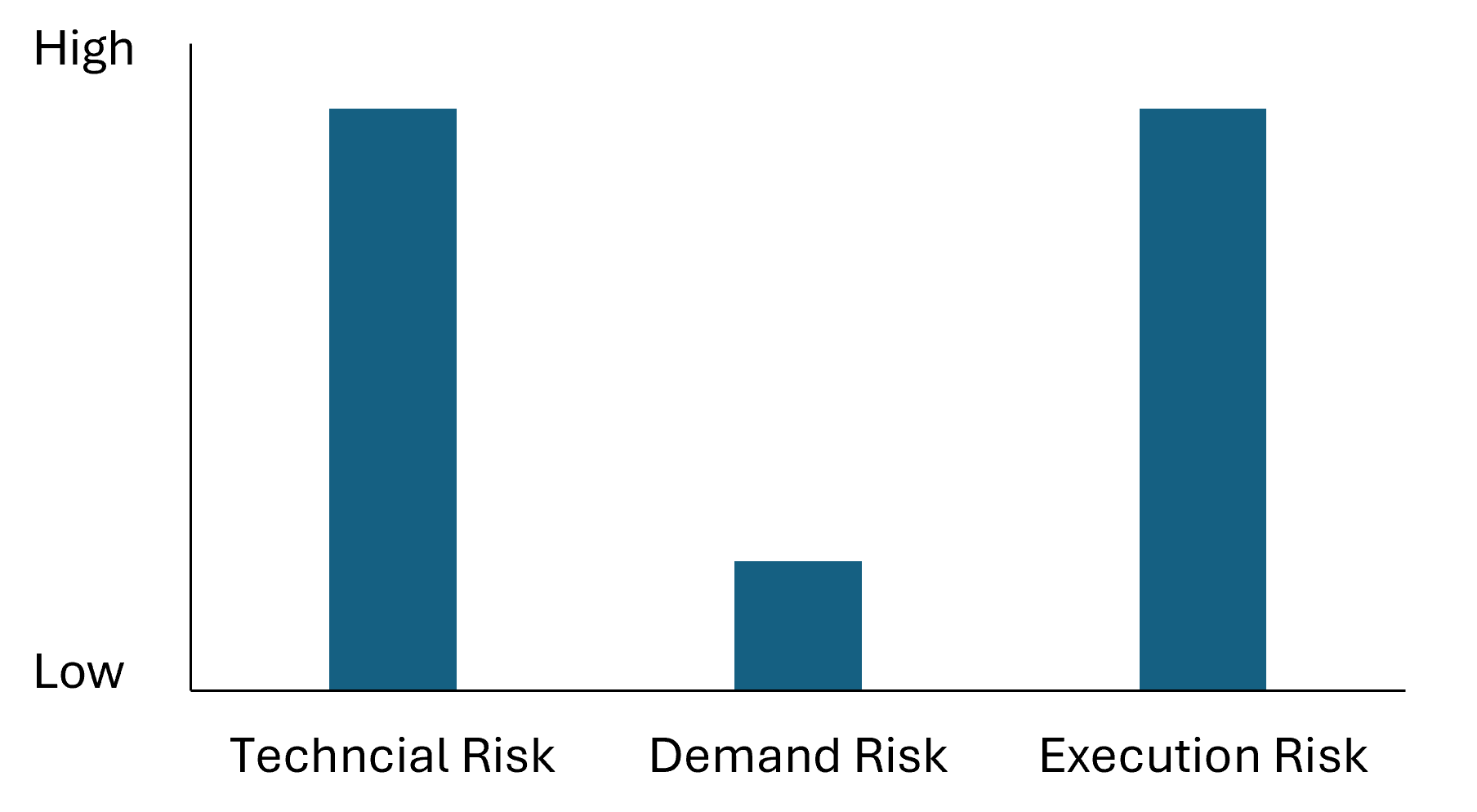

Companies in this category tend to have relatively high technical risk, low demand risk, and (because they’re manufacturing something) high execution risk. The demand risk is low because it’s typically clear who the customer of a physical product is. They’re not asking customers to change behavior. (It’s also low because investors are unlikely to fund companies with high risk across the board.) That’s a recipe for high competitive moats in big markets. I love it.

Profile of Deep Tech Hardware Startups

Type 2: National Champions

We don’t make enough stuff in the United States. Covid showed that our global supply chains can fall apart under large disruptions. Then Russia’s invasion of Ukraine showed that production rates – not stockpiles – are the correct measure of military industrial strength. Both events show the value of at least moderate self reliance. There’s an increasing awareness that we need to build our way out of these vulnerabilities. National champions strengthen and diversify domestic production, typically supported by government procurement or incentives.

Some national champions expand capacity of sorely needed material, such as Union. Others add missing capacity under what Joel Johnson calls a One Of Each policy. Like a Noah’s Ark of industrial policy, One Of Each ensures that some measure of capacity remains under US control in the event of a major disruption (flood or otherwise).

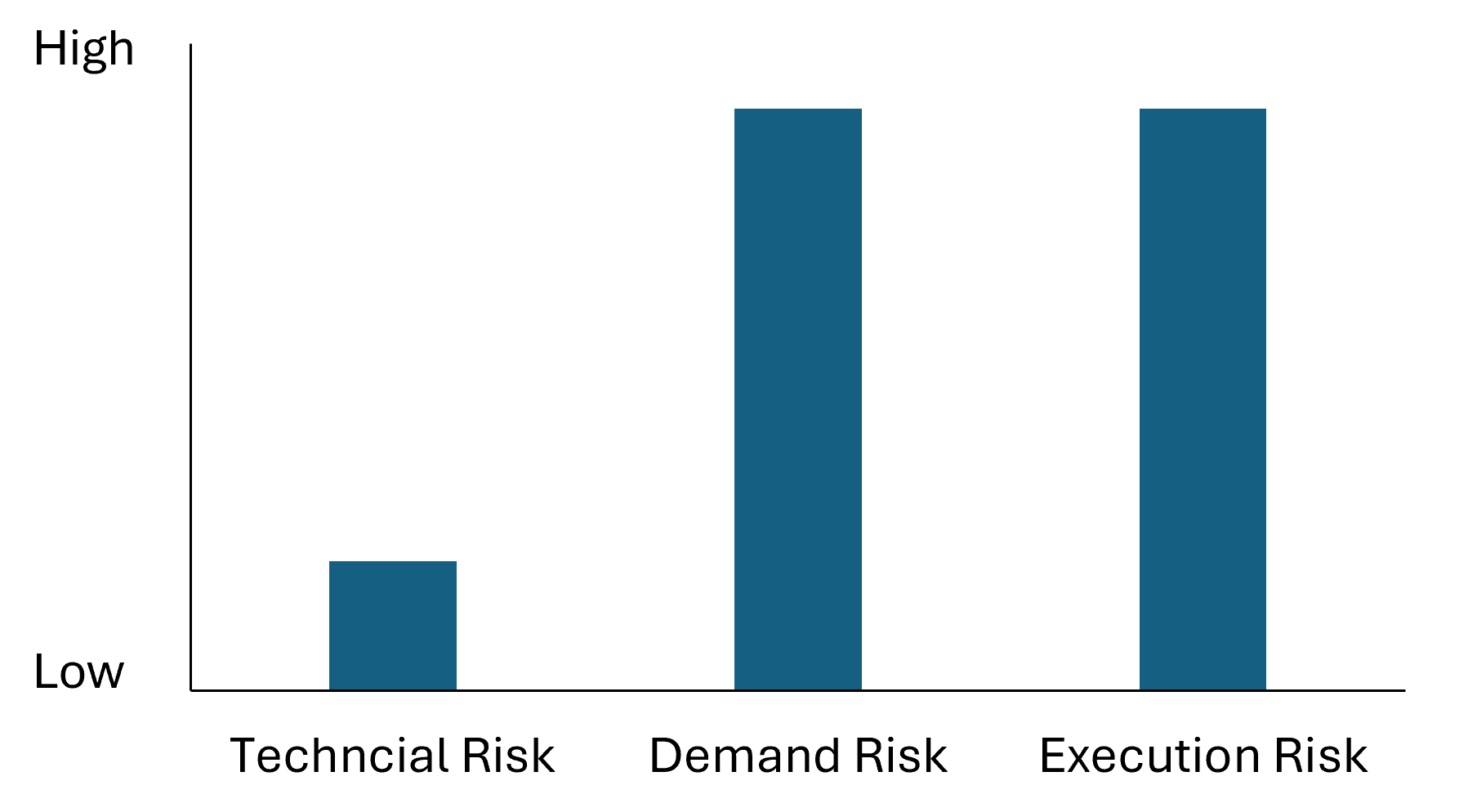

National champions tend to have low-to-moderate technical risk because they’re not inventing new products – they’re just making them here. The demand risk can be high, though, for two reasons. First, there may be numerous companies vying for a One of Each slot. Successful national champions need Narrative Command to shape public discourse to their benefit, making themselves seem inevitable. Second, the dearth of local supply is probably rooted in unfavorable economics or other structural challenges. National champions may need to lobby for federal incentives to ensure a market, which can always be repealed when political winds change. Like Deep Tech hardware companies, national champions manufacture physical goods, so they face high execution risk.

Profile of National Champion Companies

Type 3: Software Tools for Design and Manufacturing

Digital sophistication is a necessary but insufficient condition for winning in manufacturing. Everyone loves lower costs and faster results. AI native tools to automate design, manufacturing, and supply chain will reduce overhead and accelerate innovation for every type of manufacturer.

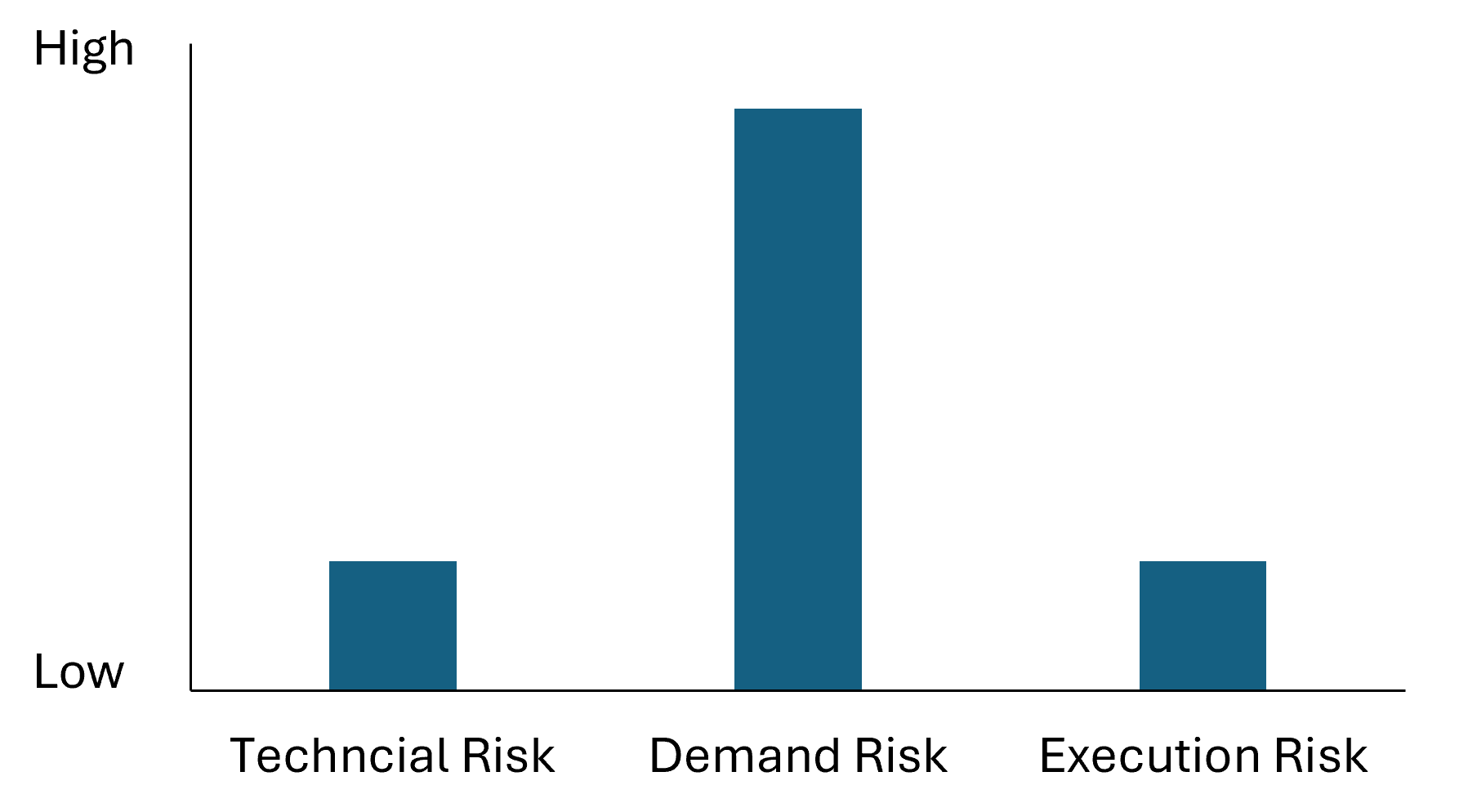

These startups face the same risks as other software companies. The technical and execution risks are relatively low, and the primary concern is demand risk. This is the best understood risk profile in all of venture, driving prioritization of product-market fit and customer acquisition cost.

Profile of Software Companies

Phony Reindustrialization: Nostalgia

Nostalgia is not real reindustrialization, it’s phony. Reindustrialization is about growth, innovation, and national security. Nostalgia is about culture. We won’t find solutions in nostalgia.

Don’t Fall for Nostalgia

Sloppy nostalgic thinking often focuses on the quantity and types of jobs available in past economies. For example, anyone pointing to the decrease in manufacturing’s share of US labor as indicative of national decline should explain why the same can’t be said for US agriculture, which is a global powerhouse. We need American manufacturers to down drive costs - including labor. I want to see lights-out factories, lights-out mines, entire lights-out supply chains!

The best American builders reject nostalgia. They’re building a new culture for a new economy. We’re not going to grow American prosperity and security by looking backward. The future of American industry is electrified, automated, and digitally sophisticated. We don’t need nostalgia because a reindustrialized American future will be so much better than the past.